Marathon Mortgages: The Rising Trend Keeping Payments Low – What Cornwall Homebuyers Need to Know

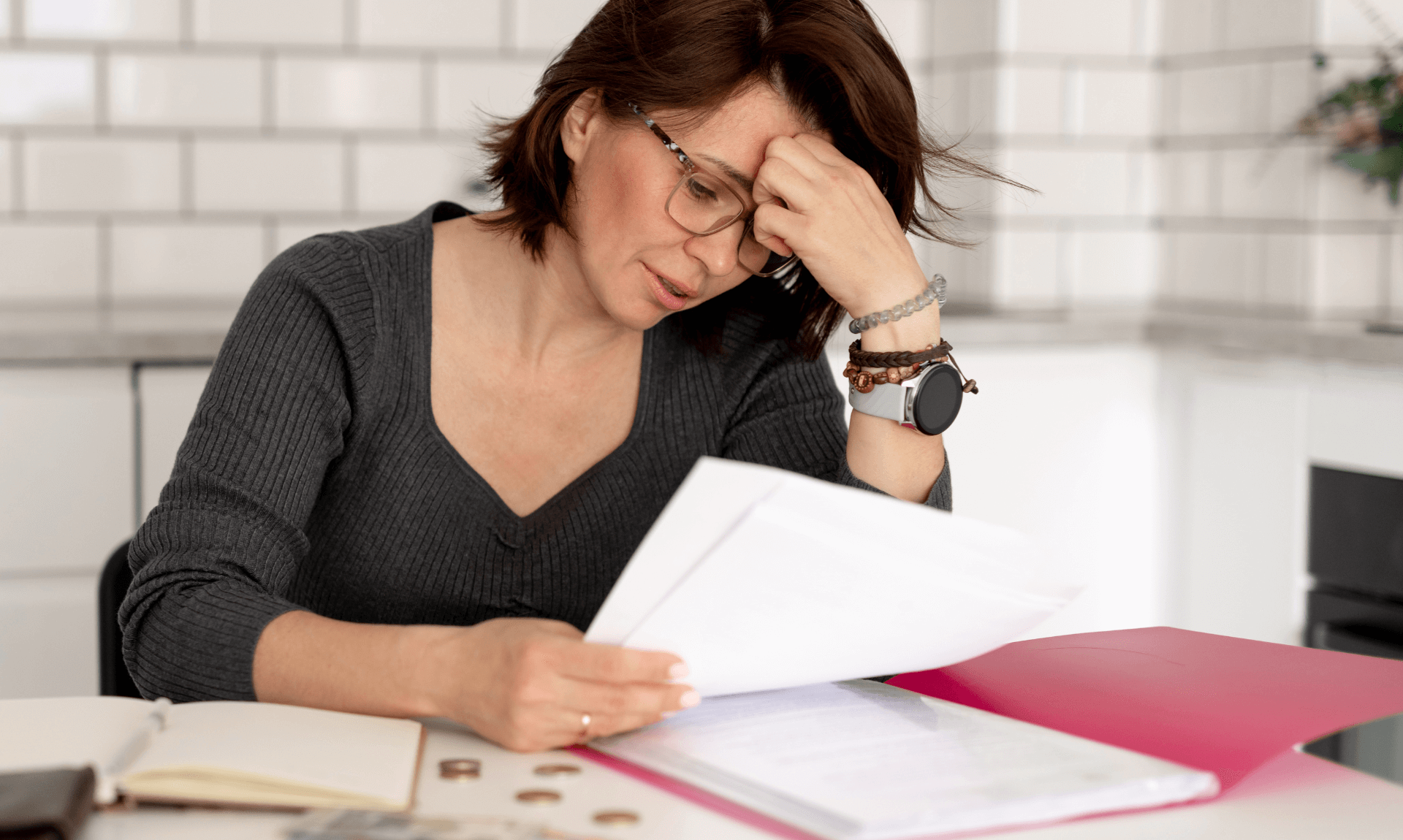

The latest Freedom of Information data from the Bank of England reveals a significant shift in the mortgage landscape, with 42% of mortgages issued in the fourth quarter of 2023 now extending beyond the state pension age of 66. This represents an 11% increase from the previous year, indicating a growing trend towards long-term mortgage commitments. Over the past three years, more than one million new mortgages have been issued with end dates stretching beyond the state pension age, highlighting the increasing popularity of these so-called ‘marathon mortgages.’

What Are Marathon Mortgages?

Marathon mortgages typically span more than 30 years, offering borrowers lower monthly payments by extending the repayment period. According to research from David Wilson Homes, demand for these long-term mortgages has skyrocketed, with a staggering 7,400% increase in related Google searches since early May 2024.

In a recent survey of 500 UK homeowners, 51% indicated that they would choose a long-term mortgage primarily for the benefit of lower monthly repayments. Among those aged 37 and over, 43% preferred a long-term mortgage to afford a larger home. Interestingly, even among retirees, 36% showed a preference for longer-term mortgages, with 40% citing lower monthly payments as their main motivation.

Interest Rates and Income Stability: Key Factors Influencing Borrowers

The survey also revealed that 31% of respondents were heavily influenced by fluctuating interest rates when choosing a long-term mortgage. This was particularly true for those aged 35-38, who cited interest rate stability as the most common reason for opting for a marathon mortgage. For those nearing retirement, aged 59-65, income stability was the primary factor, with many looking for a secure financial footing in their later years.

Expert Advice for Cornwall Borrowers

For potential homebuyers in Cornwall considering a marathon mortgage, the team from David Wilson Homes has partnered with Terry Higgins, Group MD at TNHG New Build Mortgage Services, to provide essential advice. Here are five top tips to consider before taking the plunge:

- Assess Your Financial Situation Thoroughly

With marathon mortgages potentially extending up to 40 years, it’s crucial to evaluate your current financial standing. Take stock of your income, expenses, outstanding debts, and savings to ensure you can manage a long-term loan responsibly.

- Consider Your Long-Term Goals

While extending the mortgage term can lower monthly payments, it also means paying more interest over time. Ensure that the loan aligns with your long-term financial goals and supports your overall financial well-being.

- Understand the Terms and Conditions

Marathon mortgages aren’t new, but their appeal has widened due to higher interest rates. Make sure to thoroughly review the terms and conditions of any mortgage deal, including interest rates, repayment schedules, and potential penalties for early repayment.

- Evaluate Income Stability

If your mortgage term extends beyond your planned retirement age, consider how you’ll maintain payments after retiring. Ensure you have a reliable income source and a plan to handle unexpected financial setbacks.

- Explore Alternative Options

Before committing to a long-term mortgage, explore other loan options. Compare terms, interest rates, and repayment options from different lenders to find the best fit for your circumstances.

Personalised Advice and Financial Support

Nicki Reid, Sales Director for David Wilson Homes, encourages potential borrowers to consult an independent mortgage adviser early in the house-buying process. “We always advise potential borrowers to speak to an independent mortgage adviser as early as possible,” says Nicki. “This can help ensure that a marathon mortgage is the right choice for you.”

David Wilson Homes is currently building new homes at Treledan in Saltash, Cornwall, and offers various schemes to support new home buyers, including the Key Worker Deposit Contribution Scheme and Part Exchange Guarantee. With financial support and expert guidance, potential buyers can make informed decisions and enjoy peace of mind throughout their home-buying journey.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Latest News In Cornwall

Daily Cornish news by email

The latest daily news in Cornwall, sent direct to your inbox.