Farmers Fear Forced Sales as Inheritance Tax Shake Up Looms – Concern Grows Over Future of Family Farms

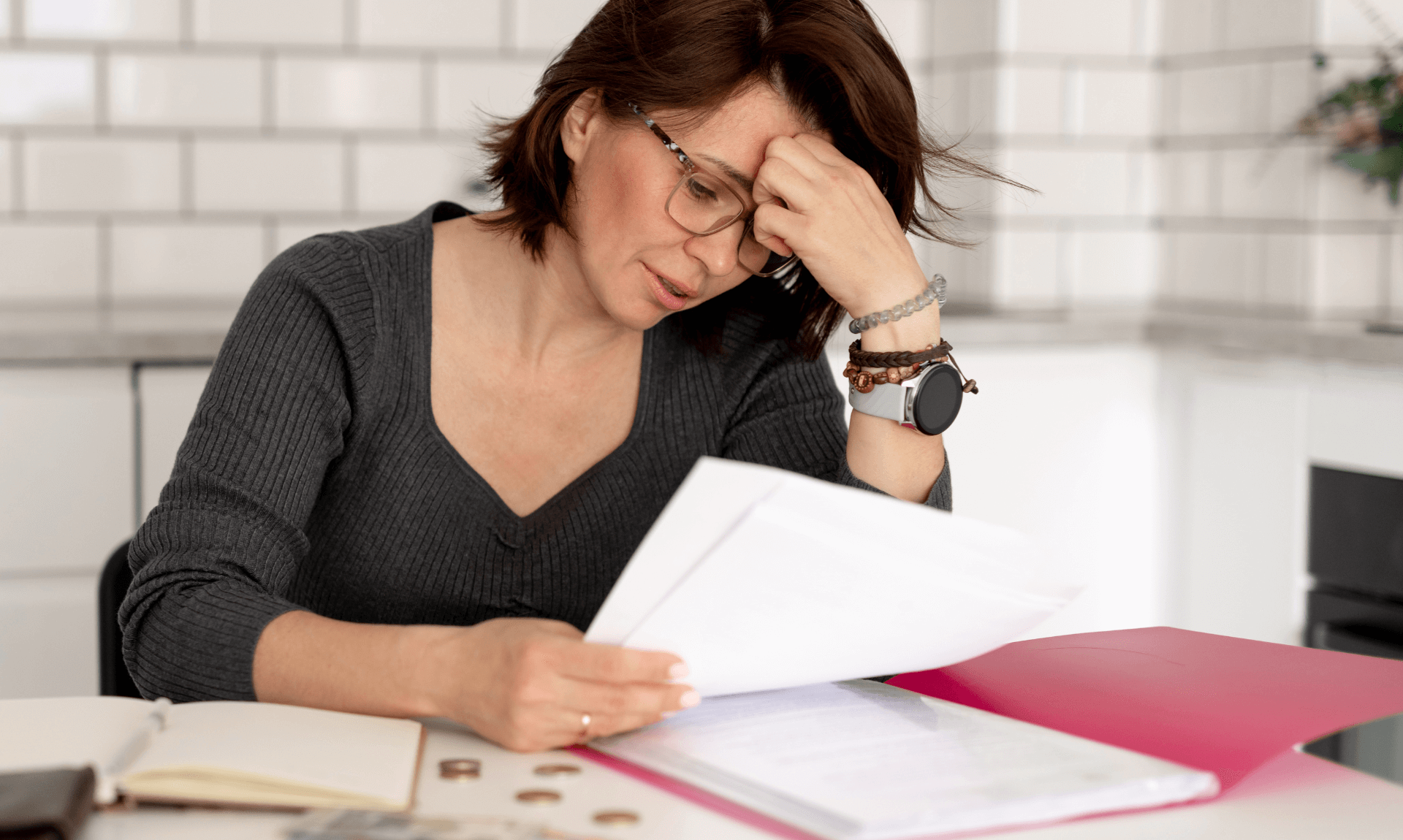

Farmers across the South West are growing increasingly anxious over proposed inheritance tax changes, fearing they could be forced to sell their land rather than pass it down to the next generation.

Annette Stone, a tax specialist at Azets, has been inundated with enquiries from worried farmers who feel their way of life is under threat.

“There’s a lot of concern and anger from farming clients – they’re reeling,” Annette said.

A Way of Life Under Threat

For many, farming is more than just a business—it’s a tradition spanning generations. But with proposed changes to the availability of inheritance tax reliefs, farmers fear their livelihoods could be at risk.

“The average farm in the region is worth £5m, but that doesn’t mean they have any disposable cash at the year-end,” Annette explained. “That money is heavily invested into farming machinery, crop and herd stock.”

The concern is that children inheriting farms may be forced to sell part or all of their land to cover tax bills, putting the future of Britain’s agricultural industry in jeopardy.

“The rise in inheritance tax poses a significant challenge for asset-rich, cash-poor businesses like farms, where children may be forced to sell part or all of their inheritance just to meet tax obligations,” she said.

The Knock-On Effect of Previous Challenges

Farmers have already faced a series of financial challenges in recent years, with many diversifying their income streams to survive.

“Many started to diversify by injecting cash or taking out loans to set themselves up with new income streams such as holiday lets, to make the farming element financially sustainable,” Annette said.

However, with inheritance tax changes now coupled with reforms to the Furnished Holiday Lets regime and other tax adjustments, farmers feel they are once again being hit hard.

“They are concerned that they will have no choice but to sell up their bloodline property and land, rather than following the centuries-old tradition of handing it on to kin, to avoid burdening their children with a hefty inheritance tax bill,” she added.

A Lack of Clarity

The uncertainty surrounding the changes has only heightened farmers’ frustration. While guidance has been issued, no concrete details have been provided by the government.

“There are no straight-forward answers as we only have guidance currently – the government has yet to give us the concrete details and the longer the delay, the more upsetting it is for farmers with modest holdings,” Annette said.

With the changes to Agricultural Property Relief and Business

Property Relief set to take effect from April 2026, many fear for the sustainability of family-run farms that have operated for generations.

Support Available for Farmers

Azets is running several seminars to help farmers navigate the changes, including sessions in Blandford Forum on 11th February and Strawberry Fields at Lifton on 13th February.

Farmers seeking more information can book a place at the events here or find more information here.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Latest News In Cornwall

Daily Cornish news by email

The latest daily news in Cornwall, sent direct to your inbox.