Warning to Directors: Avoid Rogue Insolvency Advisors or Face Severe Penalties

Engaging unlicensed advisors could result in prison or financial ruin, experts warn

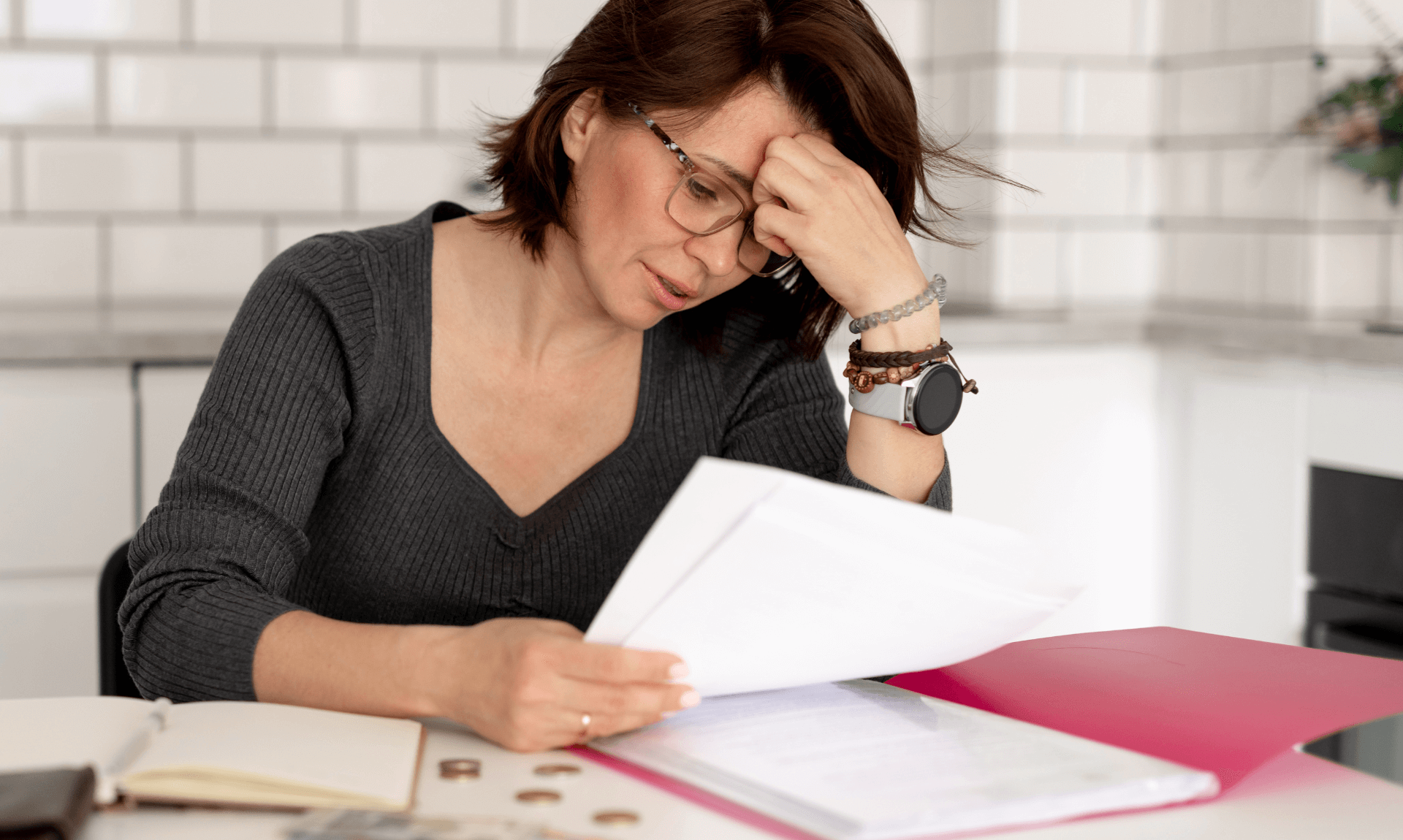

Company directors are being urged to avoid rogue unlicensed insolvency advisors as they risk severe financial penalties, being struck off as a director, or even facing prison, according to leading accountancy firm Azets.

The Risks of Rogue Advisors

Lin Gartland, a Restructuring and Insolvency Director at Azets, expressed concerns about directors turning to unlicensed advisors in the mistaken belief that they can avoid financial and legal responsibilities. These advisors often target struggling businesses via social media or direct marketing, offering to purchase share capital and relieve directors of liabilities. However, these promises are typically false, leaving directors exposed to future legal action.

Lin noted that over the last five years, hundreds of businesses have engaged unlicensed advisors, putting many directors at risk. She advised any business facing financial difficulties to seek assistance from a licensed insolvency practitioner. Licensed practitioners are regulated professionals with the experience needed to help companies navigate financial challenges safely.

Insolvency Service Crackdown

Recently, the Insolvency Service took action by winding up Save Consultants Ltd, a company that was found to be offering unlicensed insolvency services. In addition, provisional liquidators were appointed to two connected companies, Atherton Corporate (UK) Ltd and Atherton Corporate Rescue Limited, which facilitated the sale of distressed businesses.

New laws introduced in 2021 have strengthened the Insolvency Service’s ability to crack down on directors dissolving businesses to avoid paying debts. Directors caught breaching these laws can be banned for up to 15 years or, in more severe cases, face prosecution. Engaging rogue advisors only increases the risk of breaching these regulations.

The Importance of Licensed Practitioners

Lin warned that while it is becoming more difficult for rogue advisors to operate, they still pose a significant risk to directors. Changing the directors or selling a company’s share capital does not protect directors from liability, particularly when it comes to director’s loan accounts, misfeasance, wrongful trading, or reusing restricted company names.

Directors are urged to be cautious of any advisors who discourage them from seeking help from a licensed insolvency practitioner. There is a register of licensed insolvency practitioners available on the government’s website, which directors can consult to ensure they are dealing with a qualified individual.

Azets, a top ten accountancy firm in the UK, employs more than 3,800 people across 90 offices and provides a range of services to help businesses manage financial difficulties. You can learn more about Azets and their services here.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Latest News In Cornwall

Daily Cornish news by email

The latest daily news in Cornwall, sent direct to your inbox.