Don’t Miss Out: Last Chance for New Businesses to Claim R&D Tax Relief!

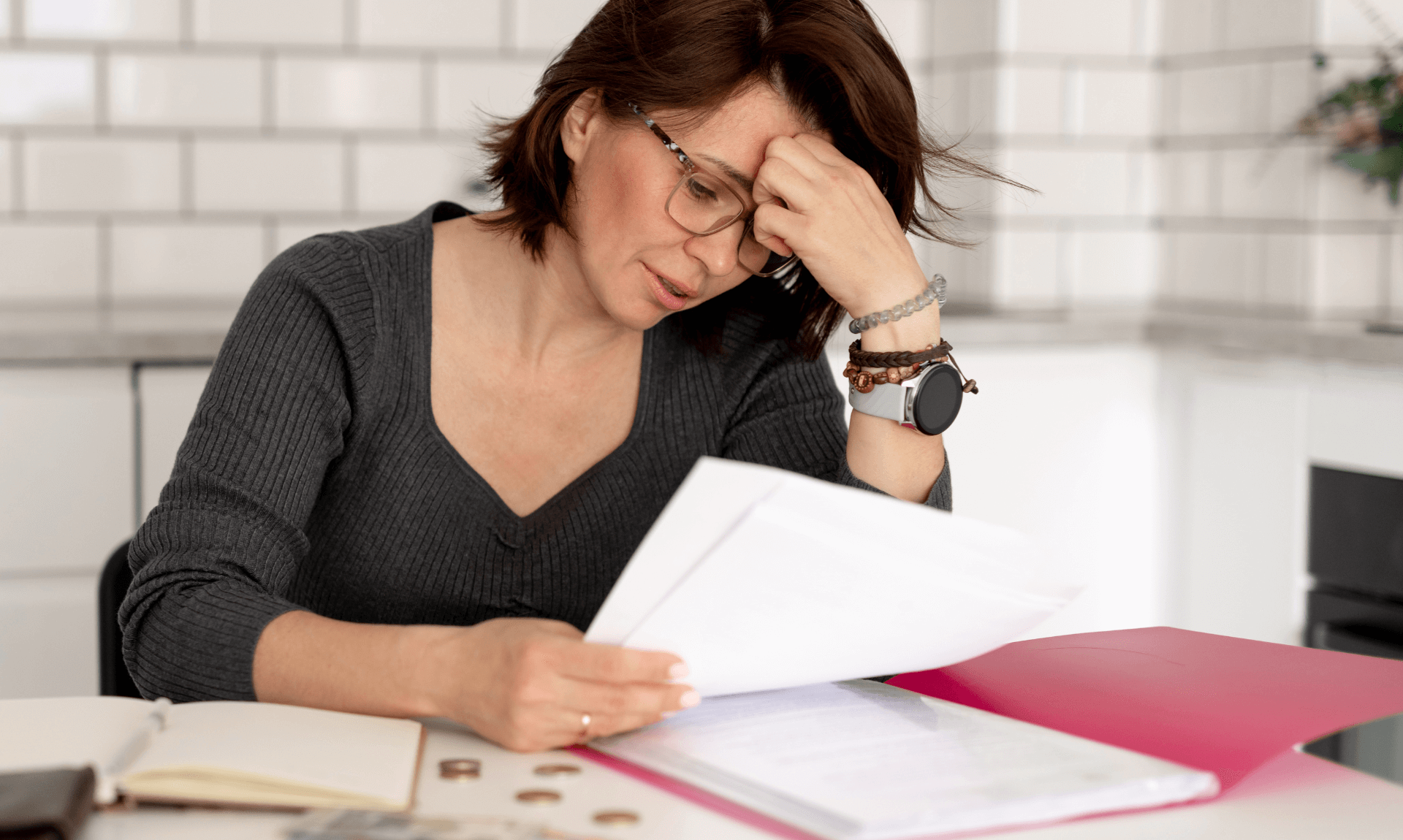

As the end of September approaches, a critical deadline threatens to bypass tens of thousands of UK-based innovative businesses, potentially costing them lucrative tax benefits.

The Impending Deadline

Newly formed companies in the UK face a significant deadline for pre-registering their R&D tax relief claims. According to Stuart Bentley, Tax Director at Azets, companies with their financial year ending in April have only until the end of September to register for their first R&D tax relief claims. Failure to meet this six-month window could mean missing out on considerable financial advantages.

Tightening Regulations

The new measures introduced by HM Revenue & Customs (HMRC) on April 1, 2023, aim to prevent abuse of the R&D tax relief system. These include curbing frivolous claims and controlling the operations of unregulated R&D consultancies. Although businesses have a two-year window to submit detailed claims once registered, missing the initial pre-registration deadline forfeits their ability to claim for that financial year.

The Value at Stake

Stuart Bentley highlighted the importance of timely action, noting that tax reliefs could exceed 20% of R&D expenditures. “Businesses need to be very careful about getting the administration of any tax relief claims organised at an early stage or they could find themselves unable to access generous tax relief,” he cautioned. In the previous tax year, R&D tax reliefs in the UK totalled £7.6 billion, marking an 11% increase from the year before, underscoring the substantial support available to innovators.

Who Needs to Act?

The updated regulations affect companies either making their first claim or those that have not claimed in the past three years. With billions at stake, the urgency to comply with the new guidelines is paramount for companies aiming to capitalise on these benefits.

About Azets

Azets is a leading international advisory firm, ranked within the top ten in the UK. The firm provides comprehensive services including accounting, tax, and advisory across a network of over 90 offices nationwide. Employing more than 3,800 professionals in the UK alone, Azets supports over 100,000 clients globally. More information on Azets’ services can be found on their website.

As businesses race against the clock, those new to the R&D tax scene must quickly navigate through these tightened requirements to secure crucial financial relief.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Latest News In Cornwall

Daily Cornish news by email

The latest daily news in Cornwall, sent direct to your inbox.