27 Employers in the South West Found to Have Underpaid Staff

27 Businesses Across Cornwall and the South West on HMRC Minimum Wage Breach List

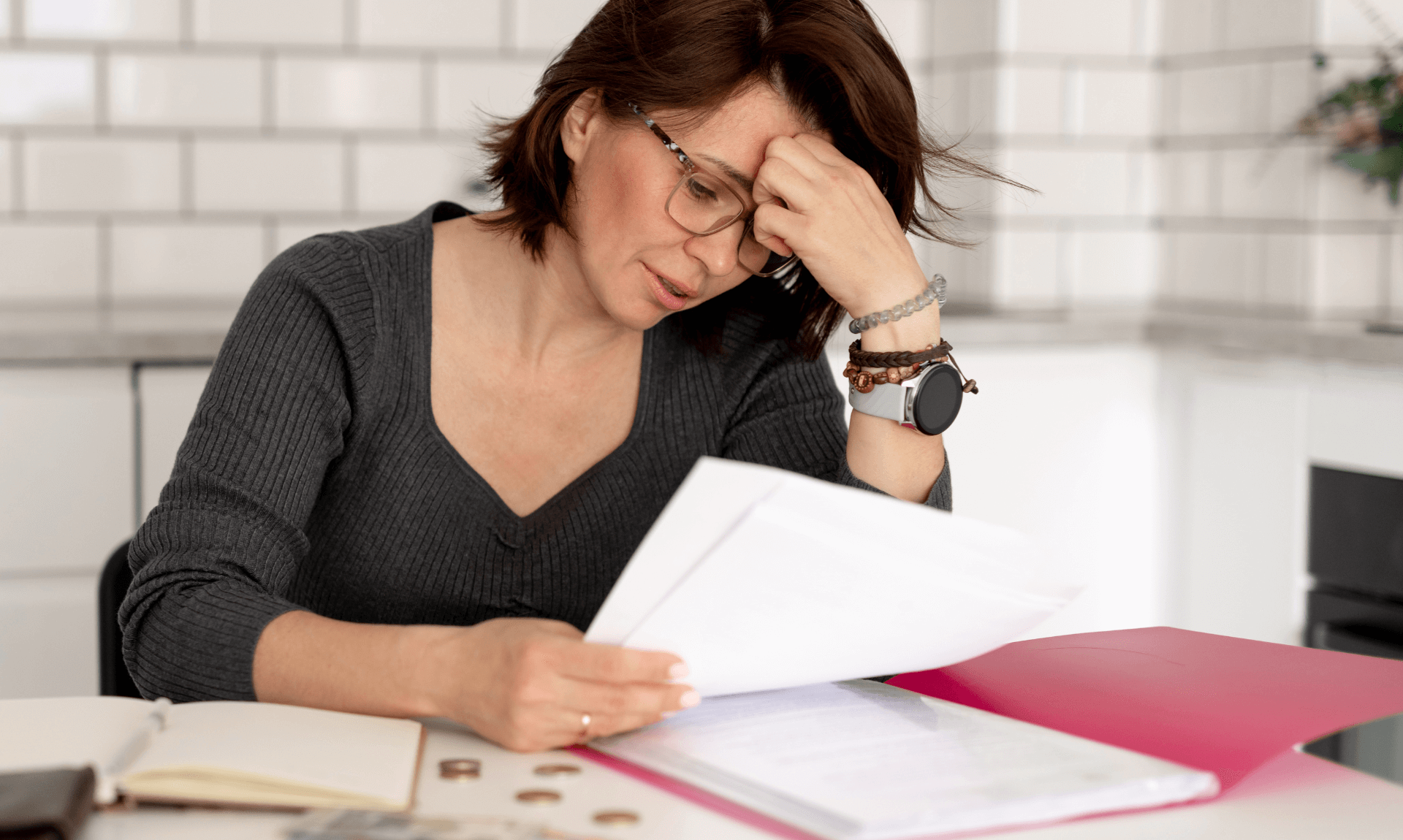

More than two dozen businesses across the South West have been named by HMRC for failing to pay workers the minimum wage.

The latest government list includes 518 employers across the UK that underpaid staff, with 27 of them based in Cornwall, Devon, Somerset, Dorset, Gloucestershire and Bristol.

According to research by accountancy firm Azets, which has regional offices in Truro, Plymouth, Blandford Forum, South Molton, Gloucester and Bristol, the 27 South West companies owed a combined £231,037 in unpaid wages to 2,295 workers.

One employer in Devon failed to pay over £89,000 to 1,648 staff, while in Cornwall another business owed more than £1,000 to two employees. Other examples included:

-

£18,830.92 unpaid to 172 employees in Somerset

-

£39,012 owed to 158 workers in Gloucestershire

-

£9,675.90 owed to four employees in Bristol

No Room for Error, Says Employment Tax Expert

Clair Williams, Head of Employment Tax at Azets, warned businesses that there’s “simply no margin for error.”

“Even if you are only underpaying a worker by 3p per week, this is enough to put your business on HMRC’s radar,” said Clair.

Some of the South West arrears averaged just 28p per worker, per week. HMRC has no threshold when it comes to repaying workers or publishing employer names.

What This Means for Employers

The penalties for non-compliance can be steep:

-

Fines of up to 200% of the underpaid amount (capped at £20,000 per worker)

-

Full repayment of wages owed

-

Being publicly named on HMRC’s breach list

-

A higher risk of future HMRC investigations

Clair said: “Employers suspected of non-compliance, even if it is a minor miscalculation, have been subject to targeted investigations and enforcement campaigns. These actions are designed to drive awareness, encourage self-correction and deter future breaches.”

The Bigger Picture

Nationally, the figures are stark:

-

518 employers named

-

£7.4 million in unpaid wages

-

Nearly 60,000 workers affected

“These figures underline both the scale of the issue and the importance of getting national minimum wage compliance right,” said Clair.

Common Mistakes That Catch Businesses Out

Even businesses that don’t intend to underpay staff can easily fall foul of the rules. Common problems include:

-

Not paying for all working time such as training, travel or waiting

-

Deductions from wages that bring pay below the legal minimum

-

Misunderstanding age-related wage brackets

-

Errors with salary sacrifice or accommodation offset calculations

Clair added: “Seek expert advice where there is uncertainty because even underpaying a worker by 3p per week has serious consequences; unintentional breaches do not amount to an acceptable excuse for HMRC.”

Azets offers detailed wage compliance checks and support for businesses facing an HMRC enquiry.

Stay Compliant

Clair advised South West employers to regularly review employment contracts, working practices and payroll records to stay compliant.

“Employers need to stay informed about annual changes to minimum wage rates and also train HR and payroll teams to recognise potential risk areas,” she said.

The full list of named employers was published by HMRC and covers investigations concluded between 2015 and 2022 and can be seen here

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Latest News In Cornwall

Daily Cornish news by email

The latest daily news in Cornwall, sent direct to your inbox.